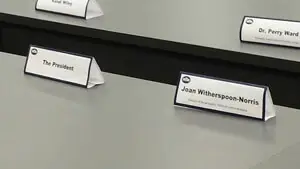

Joan Witherspoon-Norris, director of social justice for the YWCA Central Alabama, was among a group of bipartisan advocates who met with President Barack Obama Thursday about the issue of predatory lending.

“We are so thrilled that our social justice issue has the attention of the president,” Witherspoon-Norris said, referring to payday and auto title loans that carry exorbitant interest rates. “We got involved with this issue several years ago because we saw it so often with our clients. These loans take people from a financial crunch to a financial crisis.”

The diverse group of advocates has led efforts in the state to change laws that allow payday lenders to charge 456 percent interest (APR) and auto title lenders to charge 300 percent interest (APR). “I’m very proud of the bipartisan effort here in Alabama to try to change this,” the president said during his speech at Lawson State Community College following the meeting. “I want everyone to know they’re not going to have to fight this alone.”

Earlier Thursday, the Consumer Financial Protection Bureau announced proposed regulations that would reduce the number of payday loans and require lenders to examine borrowers’ incomes to ensure that they can repay the loans on schedule. “In theory, these loans help you deal with one-time expenses,” the president said. “In reality, most payday loans are not taken out for one-time expenses. They’re taken out to pay for previous loans.”

Borrowers who take out a $500 loan wind up paying $1,000 in interest rates and fees, he said, adding that there was nothing wrong with businesses making a profit. “But if you’re making that profit by trapping hard-working Americans in a vicious cycle of debt, you’ve got to find a new way of doing business,” he said.

The issue is especially widespread in Alabama. “Here in Alabama, there are four times as many payday lending stores as there are McDonalds,” the president said. “Think about that, because there are a lot of McDonalds.”

Most of the payday and title loan storefronts in Alabama are located in low-income areas, Witherspoon-Norris said. “These loan products suck money out of our communities and very often leave borrowers in a far worse financial situation than when they first got the loan,” she said.

If you or your organization would like to donate to or get involved with the YWCA, please click here.